HR Compliance – Table of Contents

The Five Ws and One H of COBRA Who is required to offer COBRA? What events are COBRA Qualifying Events? Which plans are subject to COBRA? Get all your basic COBRA questions answered here. | The U.S. Department of Health and Human Services (“HHS”) issued a Final Rule amending the HIPAA Privacy Rule, protecting the ability of individuals to receive reproductive healthcare when the care is provided lawfully. |

With growth comes increased regulatory compliance in the employee benefits and human resources world. For every set of regulations, federal and state agencies count heads in different ways. Use this roadmap to guide your regulatory compliance as a growing employer!1 |

Although most carriers will allow insurance elections to be changed within 30 days, there is no 30-day grace period under Code §125 permitting a change to a pretax election. |

The U.S. Department of Health and Human Services (“HHS”) issued a Final Rule amending the HIPAA Privacy Rule, protecting the ability of individuals to receive reproductive healthcare when the care is provided lawfully. |

HIPAA Authorization Fillable Form Authorization for release of health information Updated October 22, 2023 |

ERISA Fidelity Bonds – Protecting Your Employee Benefit Plan This document highlights key elements that employers and other plan sponsors should know about ERISA’s fidelity bonding requirements. Updated May 21, 2024 |

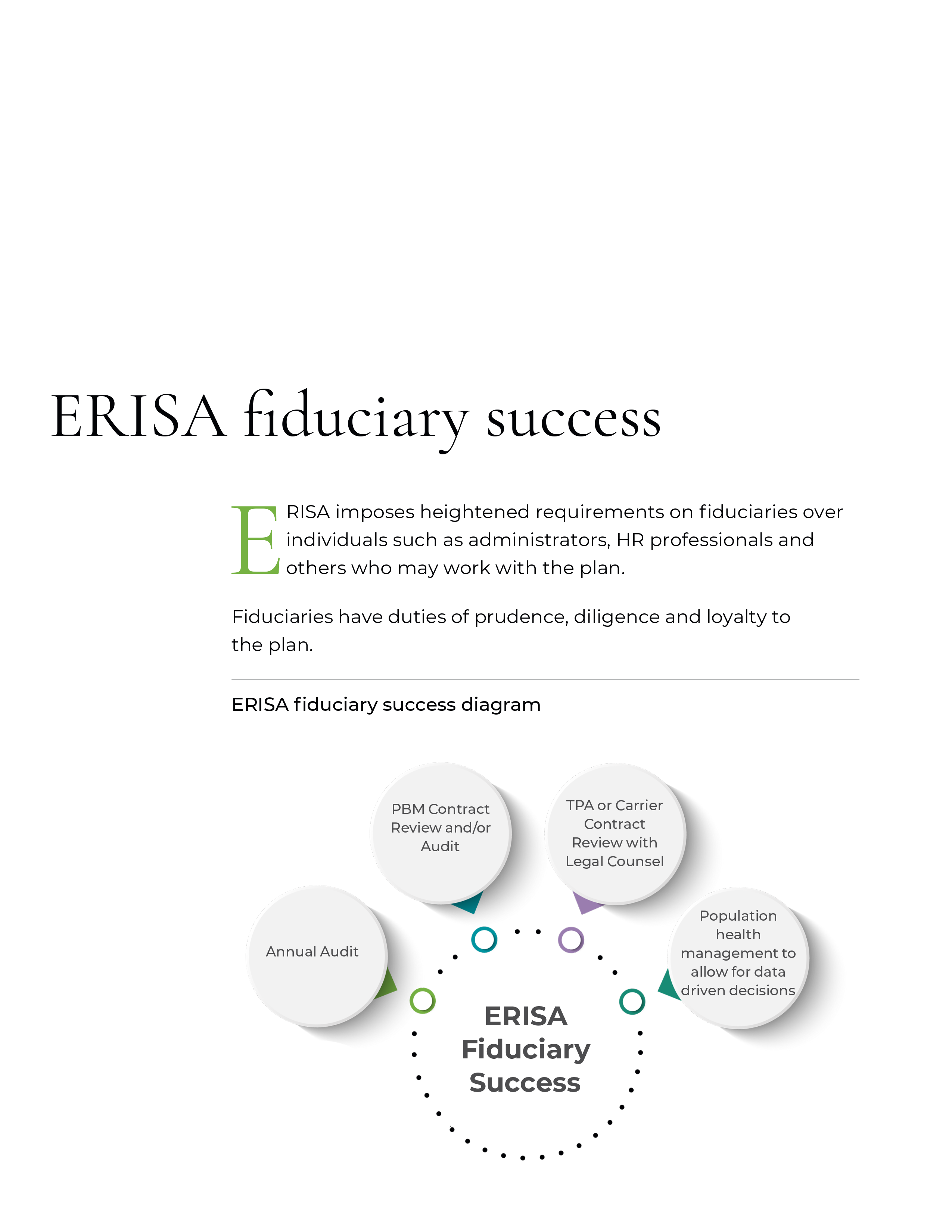

ERISA imposes heightened requirements on fiduciaries over individuals such as administrators, HR professionals and others who may work with the plan. We have identified four critical steps to success as an ERISA plan fiduciary. Updated May 21, 2024 |

Carrier Premium Credits and ERISA Fiduciary Obligations Under ERISA, anyone who has control over plan assets has fiduciary obligations and must act accordingly. Updated May 17, 2024 |

Updated April 25, 2024 |

Compliance Basics PLUS SPD Wrap & 125 POP Compliance Basics Plus makes compliance and HR simple, giving you the peace of mind that you are audit-ready and won’t be subject to fines and penalties. |

Affordability for Applicable Large Employers COVID-19 and affordability for applicable large employers Updated February 7, 2024 |

Fiduciary Responsibilities for Group Health Plan Sponsors The Employee Retirement Income Security Act (ERISA) and related legislation impose a myriad of requirements on employers including a requirement that the plan have “fiduciaries” who operate the plan in the sole interest of the participants and beneficiaries. Updated May 21, 2024 |

Government Shutdown and Employee Benefits Government shutdown and employee benefits Whitepaper Updated October 22, 2023 |  Wellness programs that offer a reward in connection with the group health plan are typically subject to HIPAA. Updated October 22, 2023 |  Mini-COBRA quick facts Updated April 25, 2024 |  Wellness Programs and Compliance Whitepaper Wellness programs & compliance: a few considerations for employers Updated April 25, 2024 |