ACA Compliance – Table of Contents

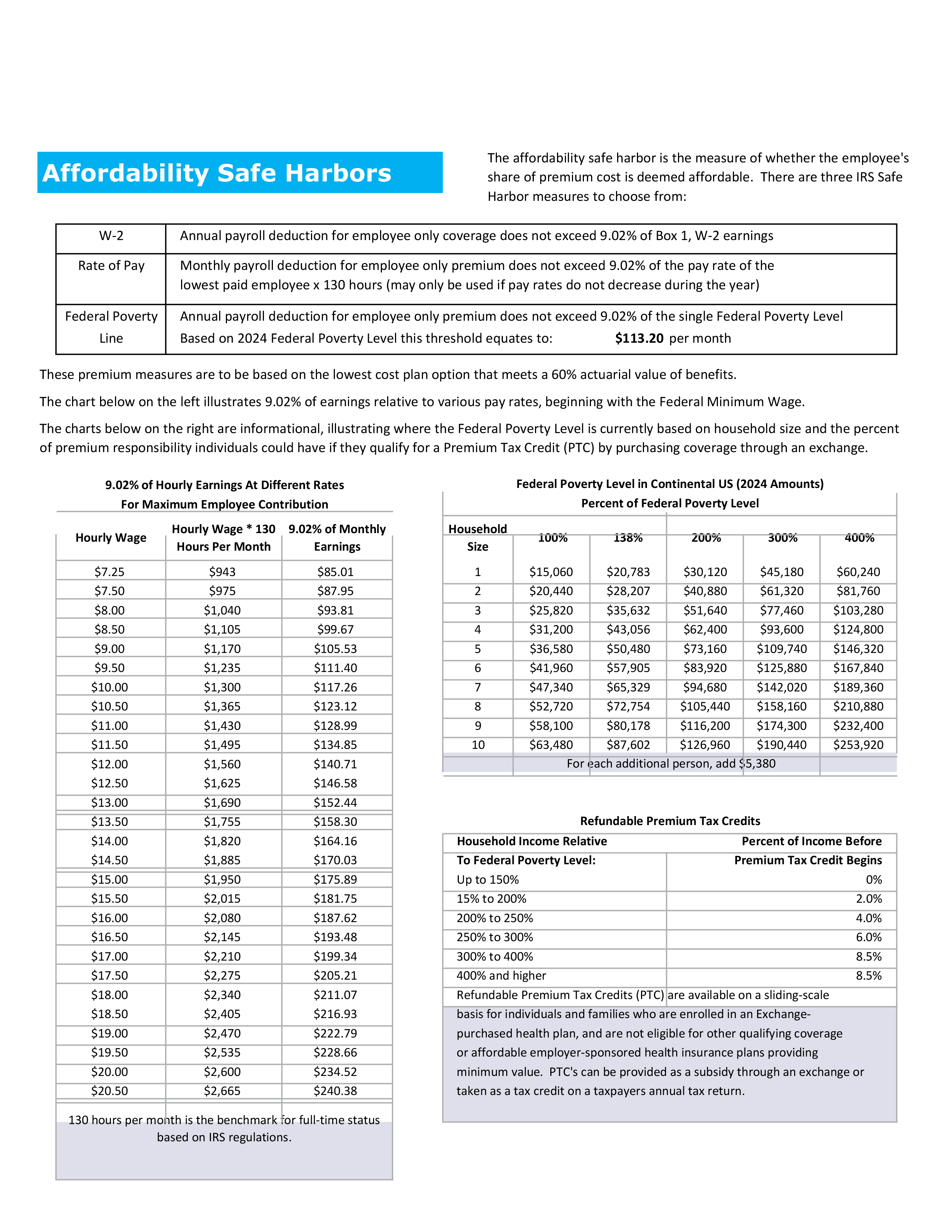

2025 ACA Affordability – Lower 48 The affordability safe harbor is the measure of whether the employee’s share of premium cost is deemed affordable. There are three IRS Safe Harbor measures to choose from. Updated October 1, 2024 |

ACA Applicable Large Employer Worksheet 2024 Calendar Year A step-by-step fillable 2024 ACA Applicable worksheet for Large Group enrollments. Updated October 22, 2023 |

Medical Loss Ratio (MLR) Rebates: What’s An Employer To Do? Updated October 22, 2023 |

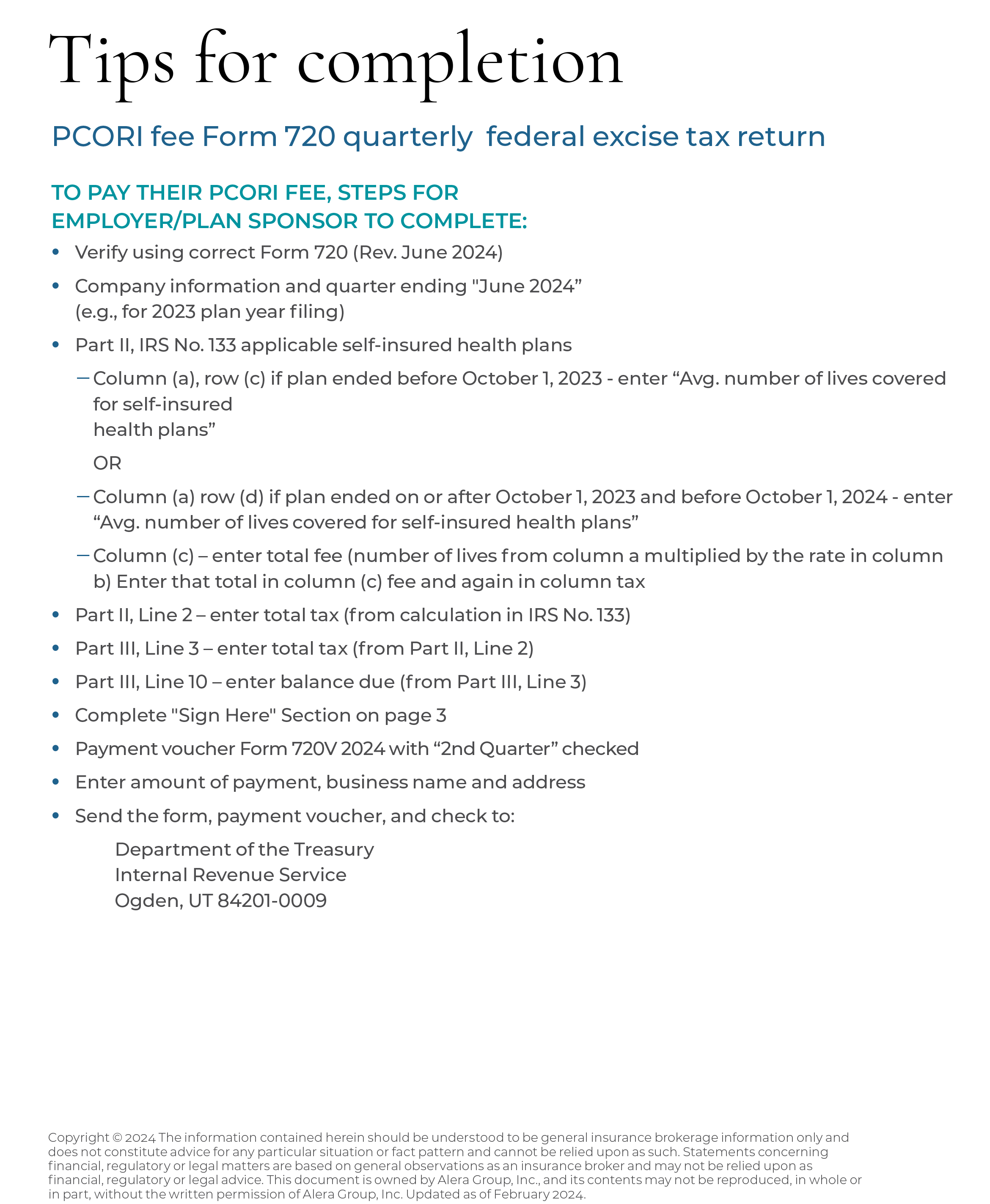

Tips for completion of PCORI fee Form 720 Find out how to complete the PCORI fee Form 720 quarterly federal excise tax return Updated October 22, 2023 | ACA Employer Mandate, Benefit Eligibility and Tracking Employees This white paper explains the rules of tracking and measuring employees under the ACA. Updated October 22, 2023 |

ACA Reporting Forms Chart Updated 21 days ago |

Frequently Asked Questions on New ACA Reporting Laws On 12/23/24, President Biden signed into law two bills, H.R. 3797 (the Paperwork Reduction Act) and H.R. 3801 (the Employer Reporting Improvement Act), which positively impacts applicable large employers (ALEs) and other entities required to furnish Forms 1095-B or 1095-C to individuals. This document answers the most commonly asked questions on these laws. Updated 21 days ago |

San Francisco Health Care Security Ordinance – 2025 Update The SF HCSO requires Covered Employers to meet the Employer Spending Requirement (ESR) by calculating and making Required Health Care Expenditures on a quarterly basis on behalf of all Covered Employees. Updated 2 months ago |

2025 benefits plan guide featuring annual benefit plan limits for 2025, retirement, key welfare plan filing deadline for 2024 and more. Updated January 2025 |

Plan document FAQ Updated 3 months ago |

Employers should be prepared to respond to IRS Employer Shared Responsibility Provision (ESRP) penalty letters and continue to prepare for 2024 reporting, which will occur in the first quarter of 2025. Updated 4 months ago |

Applicable Large Employers (ALEs) are required to offer health insurance that is affordable, provides minimum essential coverage and provides minimum value for all full-time employees and their dependents. Failure to offer coverage will result in ESRP penalties to the IRS. Updated 5 months ago |

Because these plans are often fully insured, they mistakenly believe the insurance carrier takes care of most, if not all, compliance responsibilities. However, the employer remains both accountable and liable for many compliance duties, even if the insurance carrier performs the compliance task. Updated 5 months ago |

Several new (2024/2025) employee benefit compliance requirements for 2024 and 2025 require particular attention from plan sponsors. This checklist highlights those requirements and provides reminders of some traditional year-end employee benefit compliance considerations. Updated 5 months ago |

This calculator is based on the 2025 ACA Affordability Safe Harbor percentage of 9.02%. It is based on the 2024 Federal Poverty Level of $15,060. Updated October 17, 2024 |

The IRS has released Rev. Proc. 2023-29, which contains the inflation adjusted amounts for 2024 used to determine whether employer-sponsored coverage is “affordable” for purposes of the Affordable Care Act’s (ACA) employer shared responsibility provisions and premium tax credit program. Updated July 29, 2024 |

Once an employee enrolls in their employer’s benefits on a pretax basis through their Section 125 or Cafeteria plan, the IRS does not allow employees to make changes to their pretax elections until the plan year ends, unless a permitted event sometimes called a qualified life event. Updated July 17, 2024 |

Employers that sponsor group health plans are often interested in offering benefits to different groups of employees in distinct ways. Find out about the several reasons that employers consider this. Updated July 17, 2024 |

All private and public sector employers with 20 or more employees are required to offer temporary continuation coverage to qualified beneficiaries. Updated July 16, 2024 |

The IRS requires all applicable large employers, including nonprofit, and government employers to report to the IRS whether they offered minimum value affordable coverage to its full-time employees to avoid a penalty. Updated July 16, 2024 |

The City and County of San Francisco require most employers to either provide health coverage, pay an employee’s actual health care expenses, or make payments to the Healthy San Francisco program. There are changes for the 2023 calendar year. Updated July 12, 2024 | Employee Benefits Nondiscrimination Basics 2023 This whitepaper discusses the four main nondiscrimination provisions applicable to group health plans - ACA Section 1557 for covered employers, HIPAA based on health factors, Section 105(h) for self-insured plans, and Section 125 pretax contributions. Updated April 29, 2024 |  Affordable Care Act (ACA) Affordability Safe Harbors WHO needs to worry about affordability safe harbors? This Document covers everyone who should be concerned. Updated February 21, 2024 |  ACA Reporting – Final Forms & Instructions for 2022 and Final Regulations Granting Permanent Relief for 2023 & Beyond Updated February 12, 2024 |

Health and Welfare Plan Compliance Checklist 2024 Updated February 7, 2024 |

California Summary of Dental Benefits and Coverage The SDBC requirements applies to fully insured dental plans written in the State of California Updated October 22, 2023 |  The ADA and GINA have different, stricter incentive limits than the HIPAA limits. Financial incentives for wellness programs regulated by GINA are the same as the ADA Updated October 22, 2023 | Employee benefits client service strategy Updated October 22, 2023 |

PCORI Fee Form 720 – Tips for Completion Employers can follow these simple steps to pay their PCORI fee. Updated July 17, 2024 |