Employee Benefits – Table of Contents

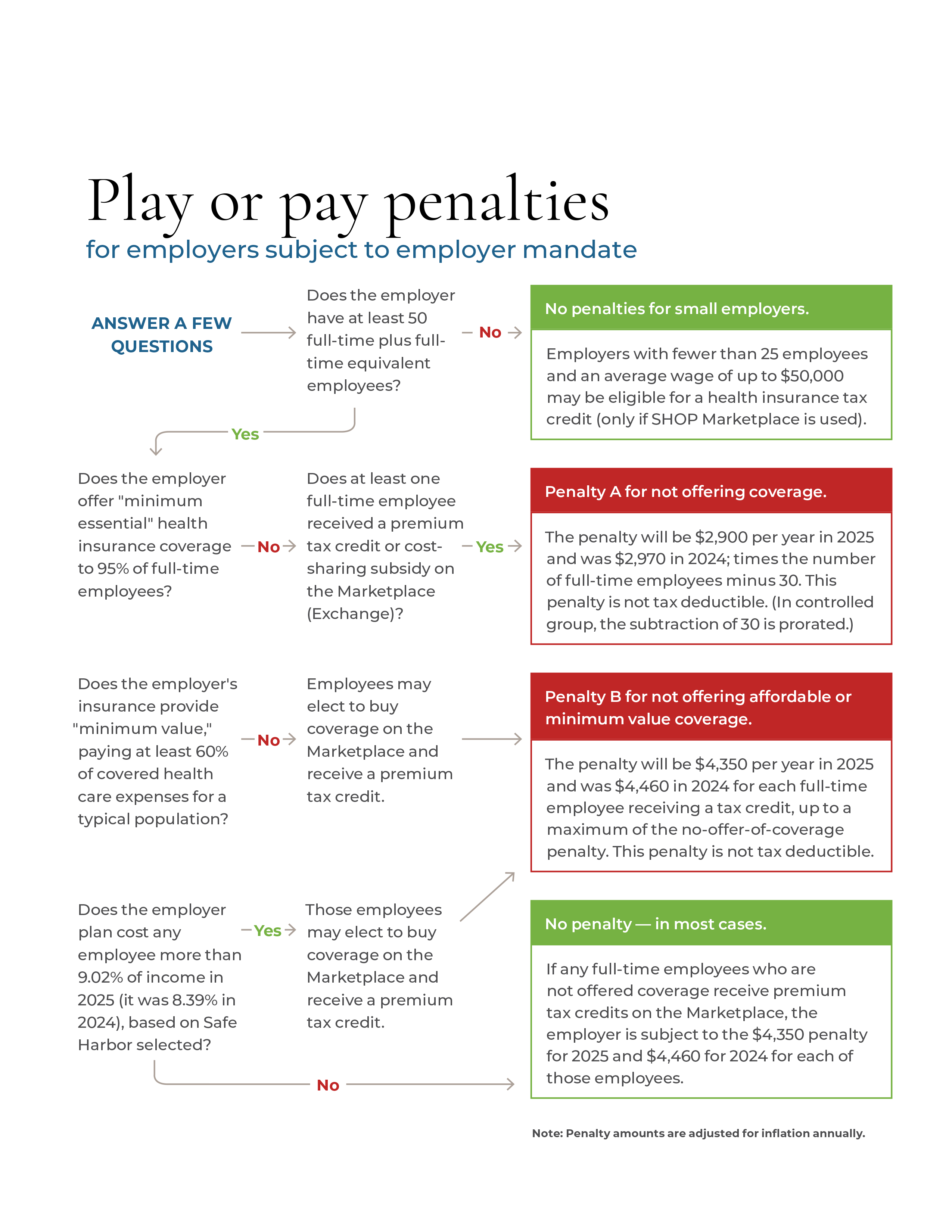

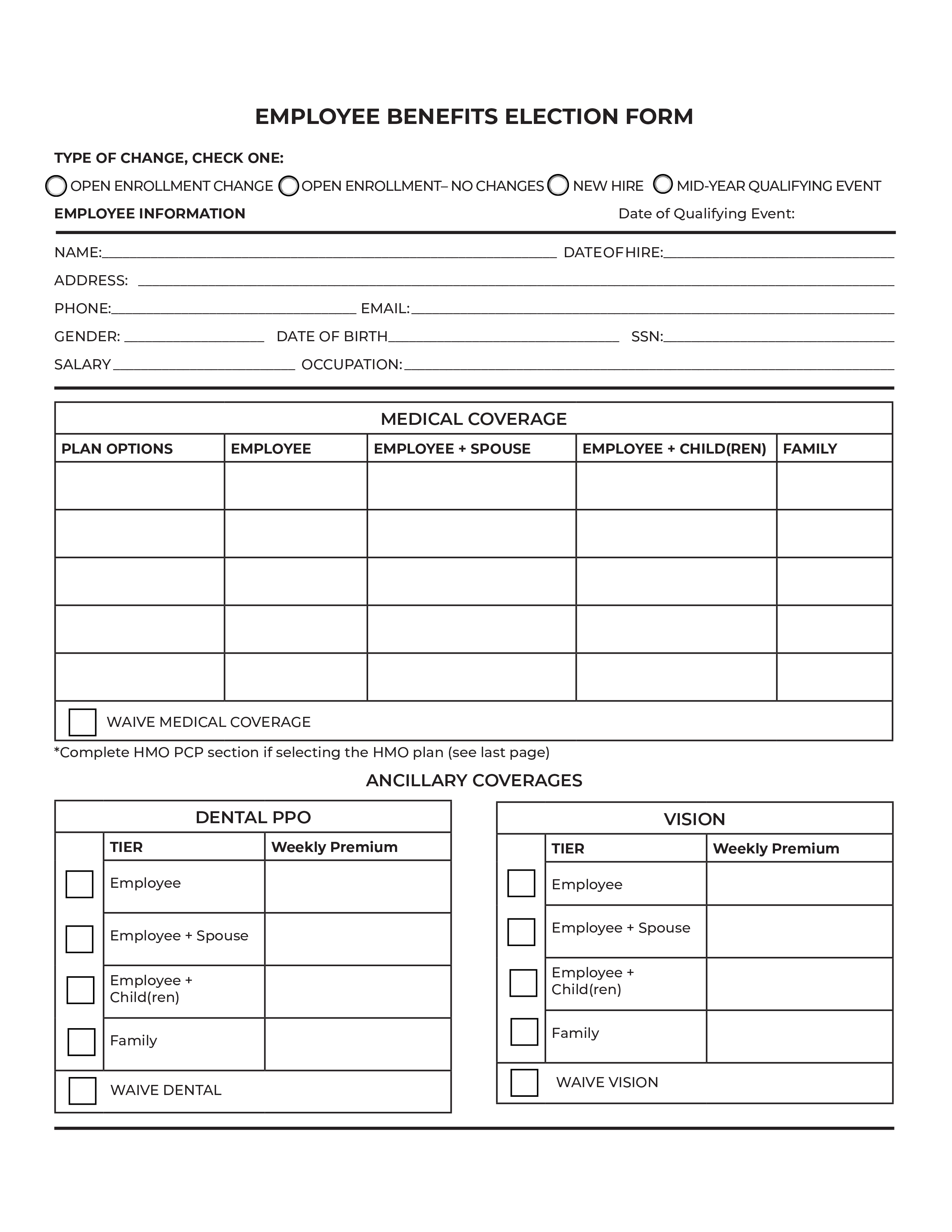

Switching from a fully insured group health plan to a self-funded, or self-insured, plan shifts several compliance responsibilities and risks. This paper outlines some key compliance considerations for self-funded plans, including level-funded plans. Updated 5 months ago | Play or Pay Penalties for Employers Play or pay penalties for employers subject to employer mandate. Answers to a few questions. Updated October 1, 2024 | Advanced Health Plan Strategies Take control with advanced health plan strategies Updated October 22, 2023 | Employee Benefits Election Form Download and brand this completely fillable employee benefits insurance enrollment form. Updated August 21, 2024 | Tax Considerations for Wellness Programs Employee sponsored wellness programs have a variety of tax considerations employers must properly consider in their implementation. Updated July 15, 2024 |

Sponsors of self-funded ERISA plans have fiduciary obligations to plan participants, which include the obligation to provide a full and fair review of claims, and effectively and meaningfully communicate or engage with plan participants regarding claim denials. Updated May 21, 2024 |

Employee Benefits Nondiscrimination Basics 2023 This whitepaper discusses the four main nondiscrimination provisions applicable to group health plans - ACA Section 1557 for covered employers, HIPAA based on health factors, Section 105(h) for self-insured plans, and Section 125 pretax contributions. |  Personalize Your Program with Voluntary Benefits Voluntary benefits are a cost-effective way for employers to expand their benefits program and offer employees choices that meet their unique needs. Updated March 11, 2024 |

Gender Affirming Care Exclusions in Group Health Plans Since many gender-affirming care options seem to be voluntary or cosmetic to non-medical professionals, this area has become heavily litigated in the last few years. These lawsuits bring claims under a multitude of laws, including the Employee Retirement Income Security Act of 1974 (ERISA), Section 1557 of the Affordable Care Act, Titles VII and IX of the Civil Rights Act of 1964, and the Equal Protection Clause of the 14th Amendment Updated March 1, 2024 |  Transparency in Coverage and CAA Provisions Status Update A summary of TiC Final Rules and CAA provisions that employers sponsoring self-insured/level-funded plans are responsible for Updated March 1, 2024 |

Consolidated Appropriations Act Crucial questions that brokers with self-funded and level funded health plans should be asking the TPA and/or Carrier Administrator Updated March 1, 2024 |

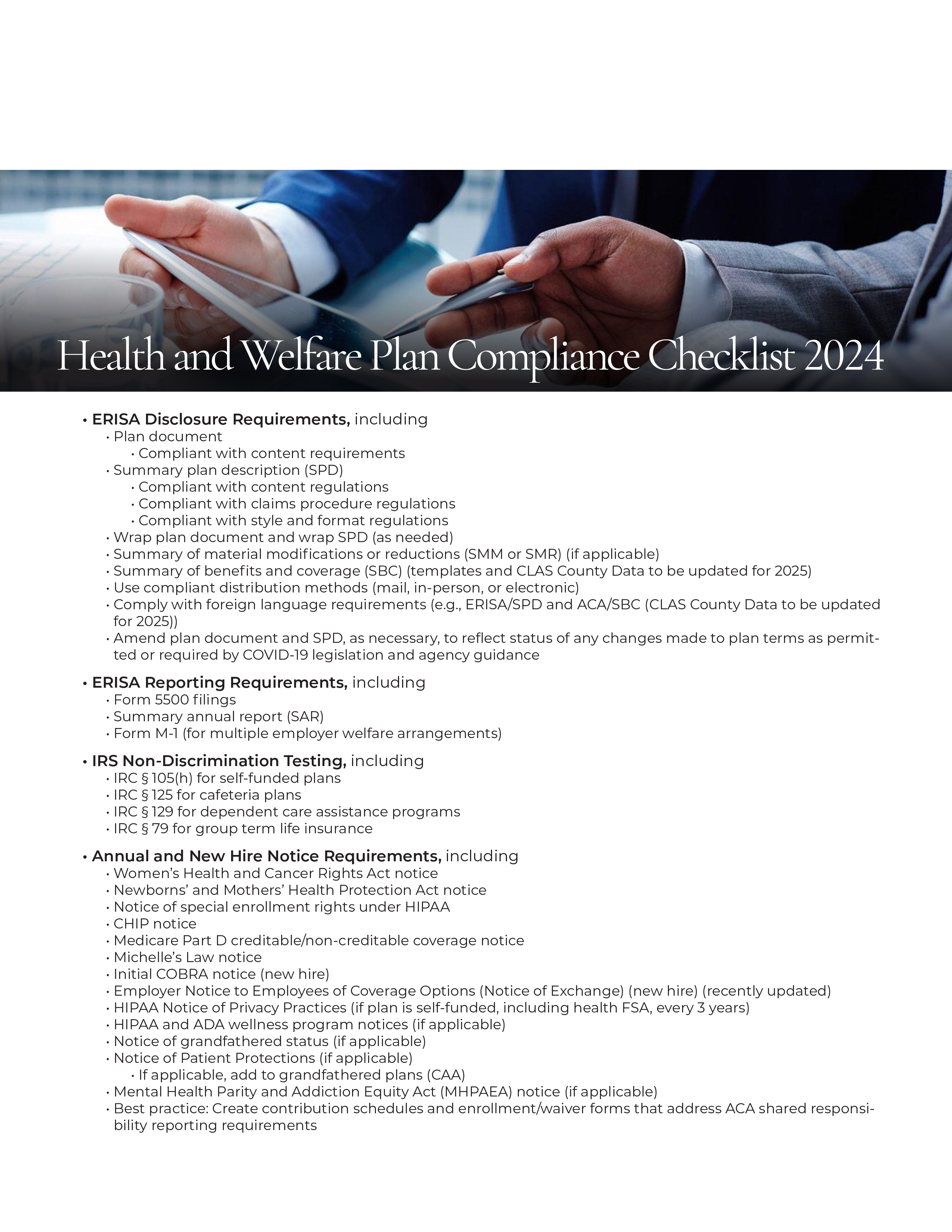

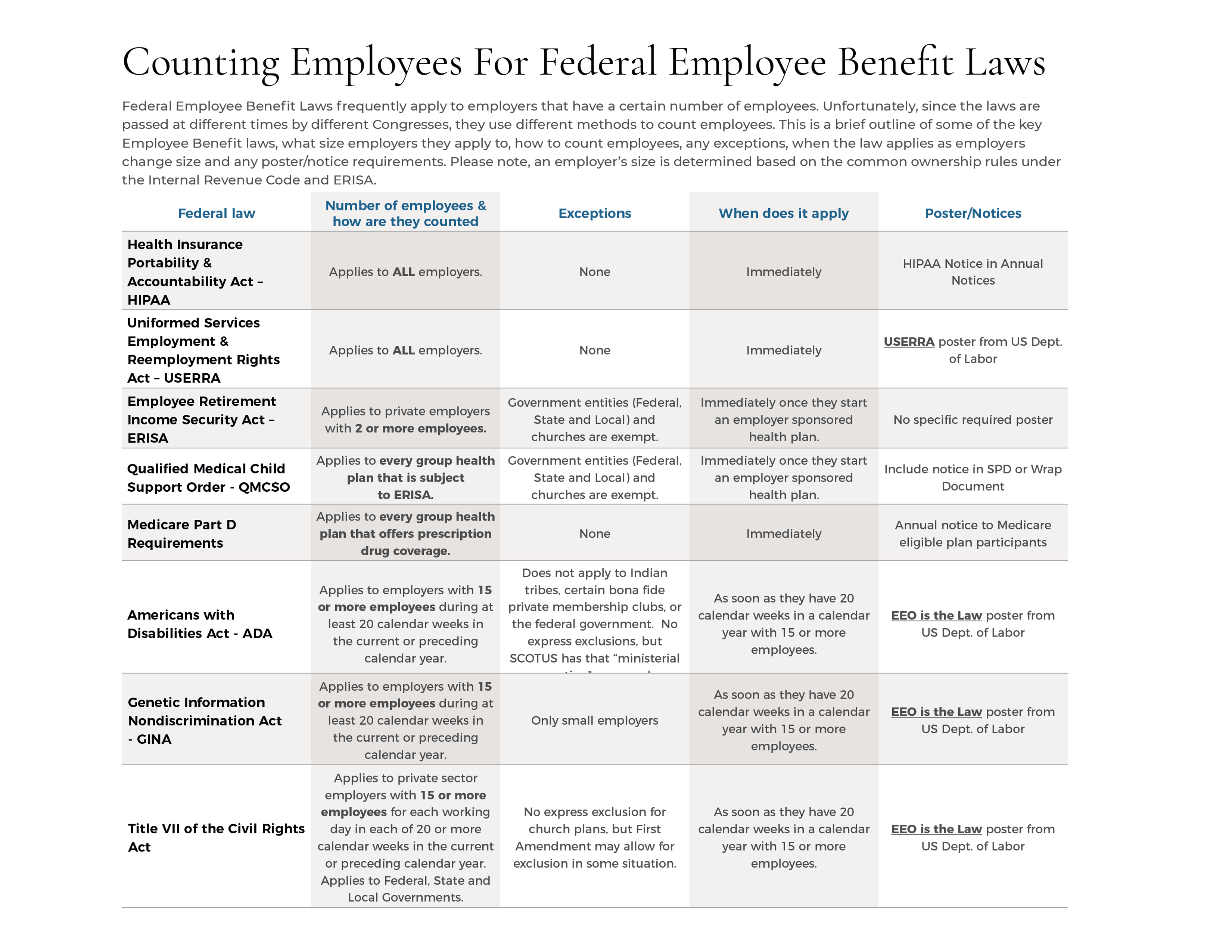

Legal Alert: Self-Funded Plan Administrators Fiduciary Obligations Sponsors of self-funded ERISA plans have fiduciary obligations to plan participants, including the obligation to provide a full and fair review of claims, and communicate or engage with plan participants regarding claim denials. Updated March 1, 2024 | Health and Welfare Plan Compliance Checklist 2024 Health and Welfare Plan Compliance Checklist 2024 Updated February 7, 2024 | Counting Employees For Federal Employee Benefit Laws This is a brief outline of some of the key Employee Benefit laws, what size employers they apply to, how to count employees, any exceptions, when the law applies as employers change size and any poster/notice requirements.. Updated November 15, 2023 |

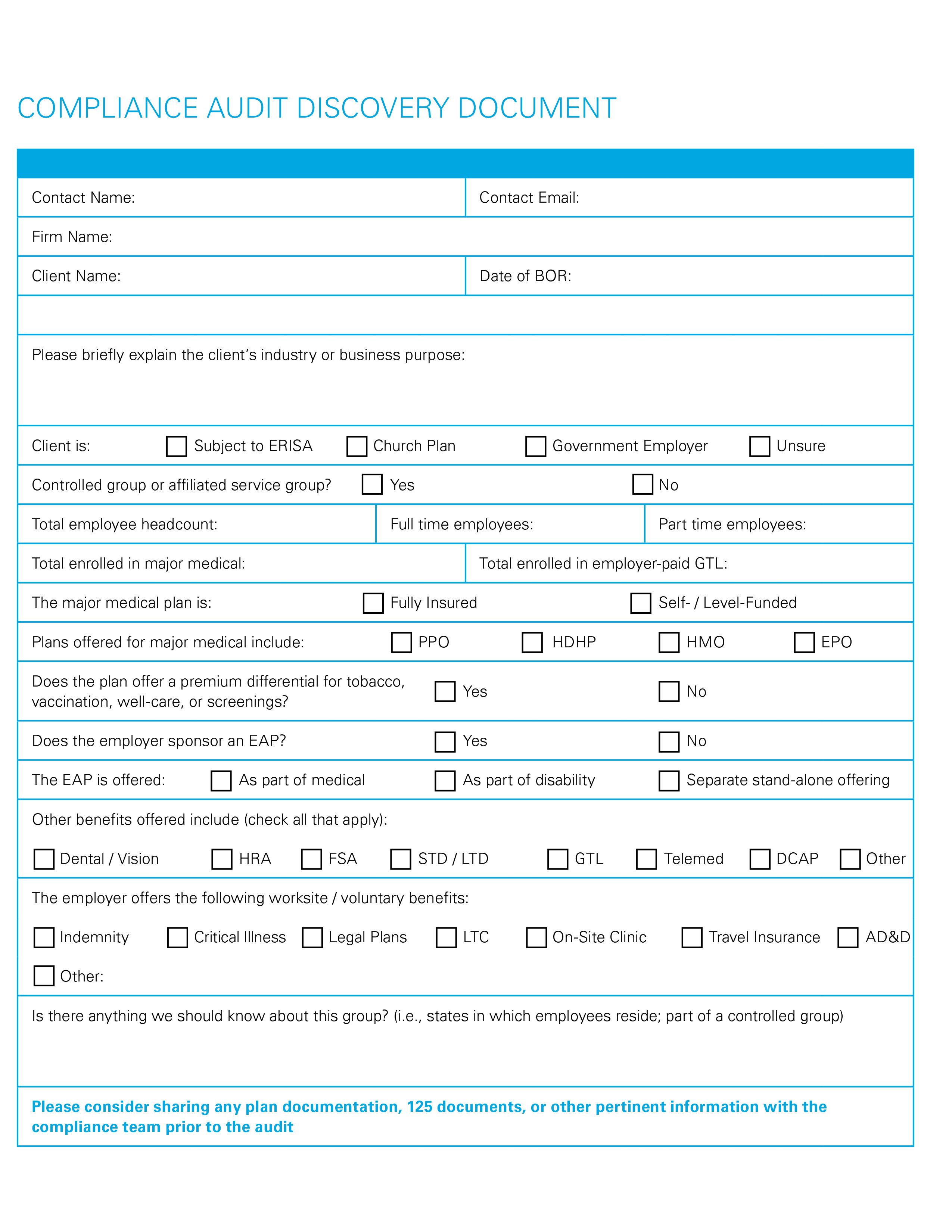

EB Compliance Audit Discover Document This document is used in preparation for a Compliance Audit. After completion, send it and the related materials to your Compliance Contact for review prior to the client audit. Updated October 22, 2023 |

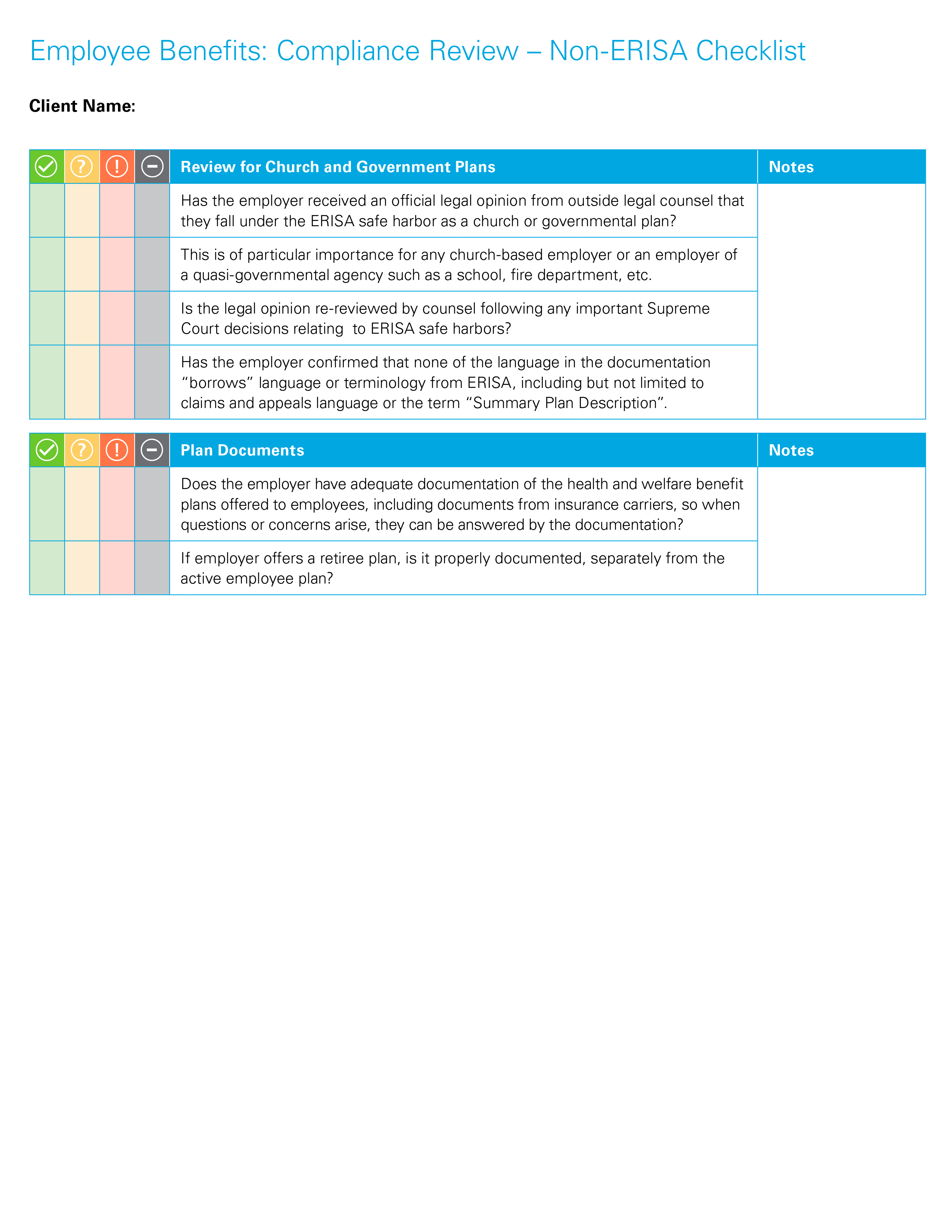

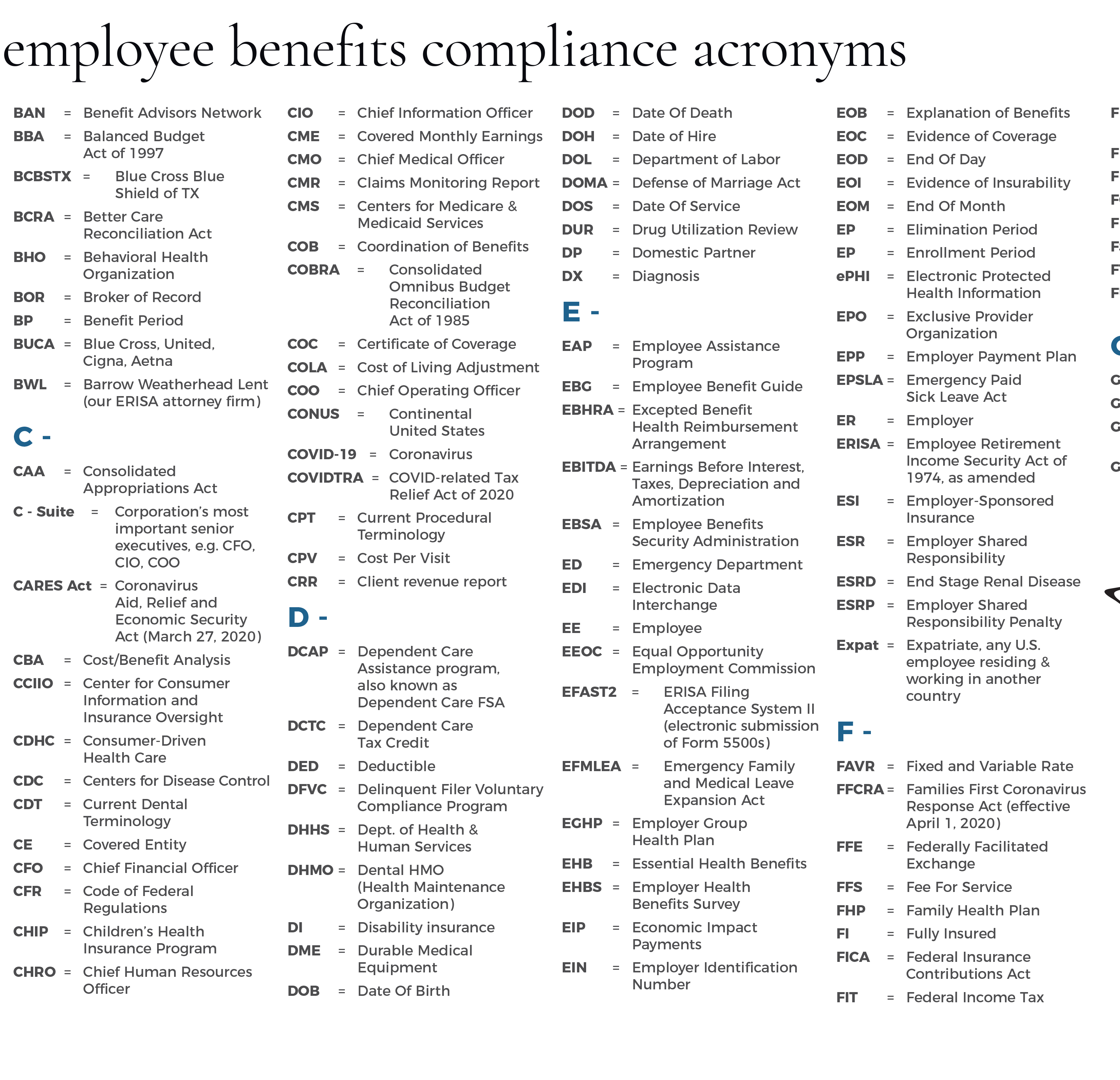

This Non-ERISA checklist is used during Compliance Audit / Reviews led by COE with Clients and is updated routinely to reflect indexed amounts. Updated October 22, 2023 | Know your employee benefits compliance acronyms Know your employee benefits compliance acronyms Updated October 22, 2023 |  Benefits Benchmarking Benefits BenchmarkingGain Insights and Control Spending through Benefits Benchmarking Updated October 22, 2023 |

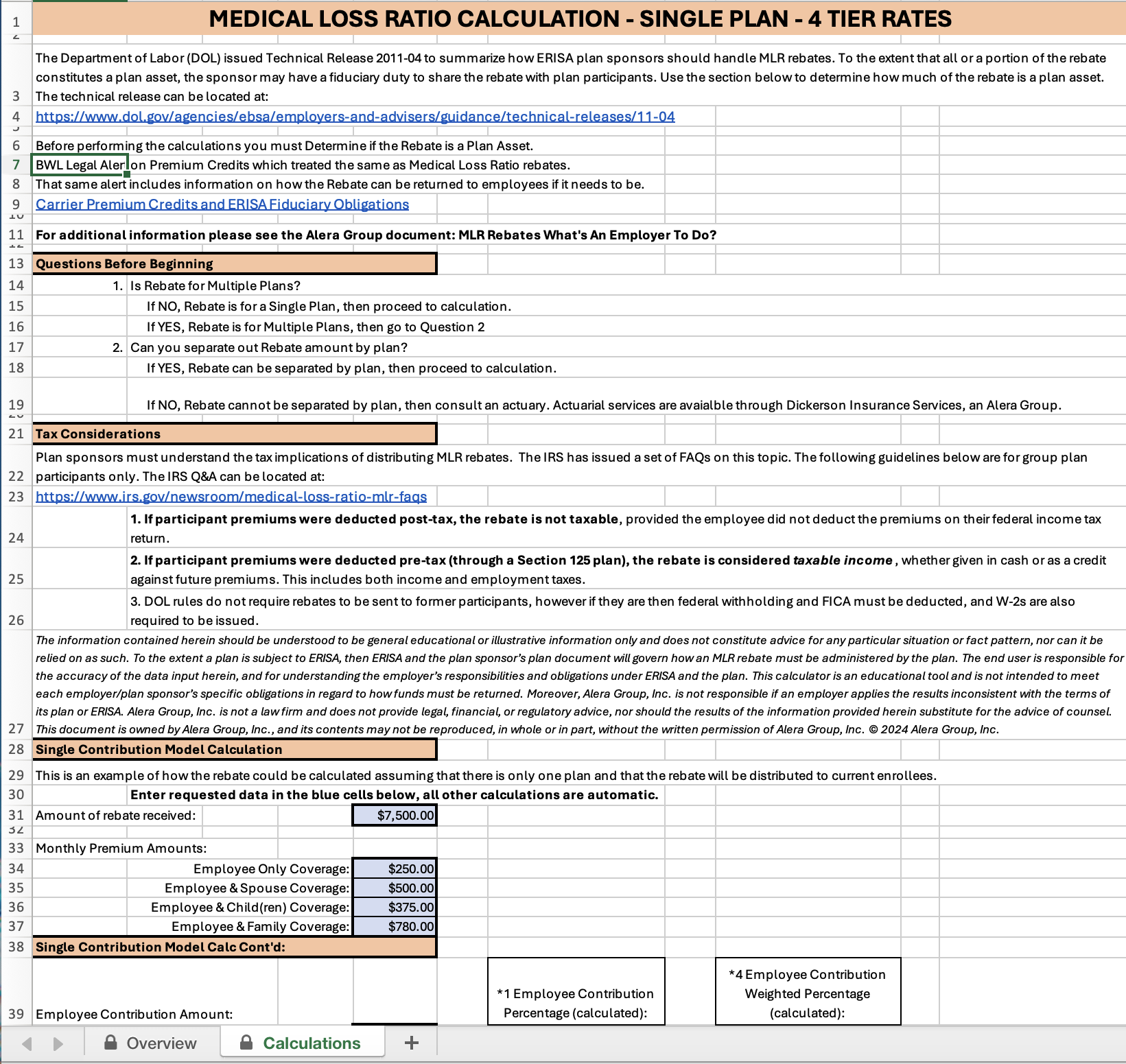

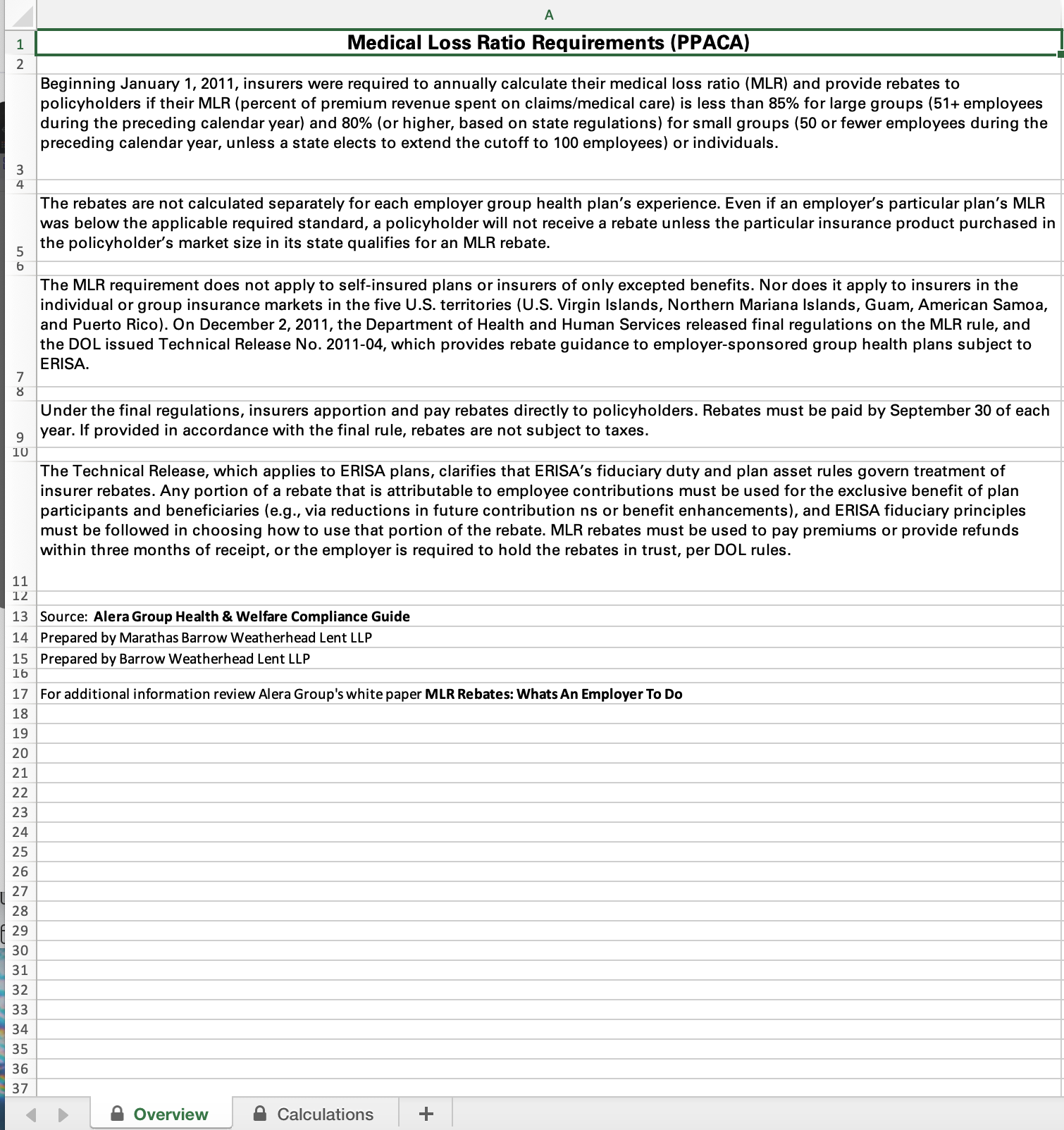

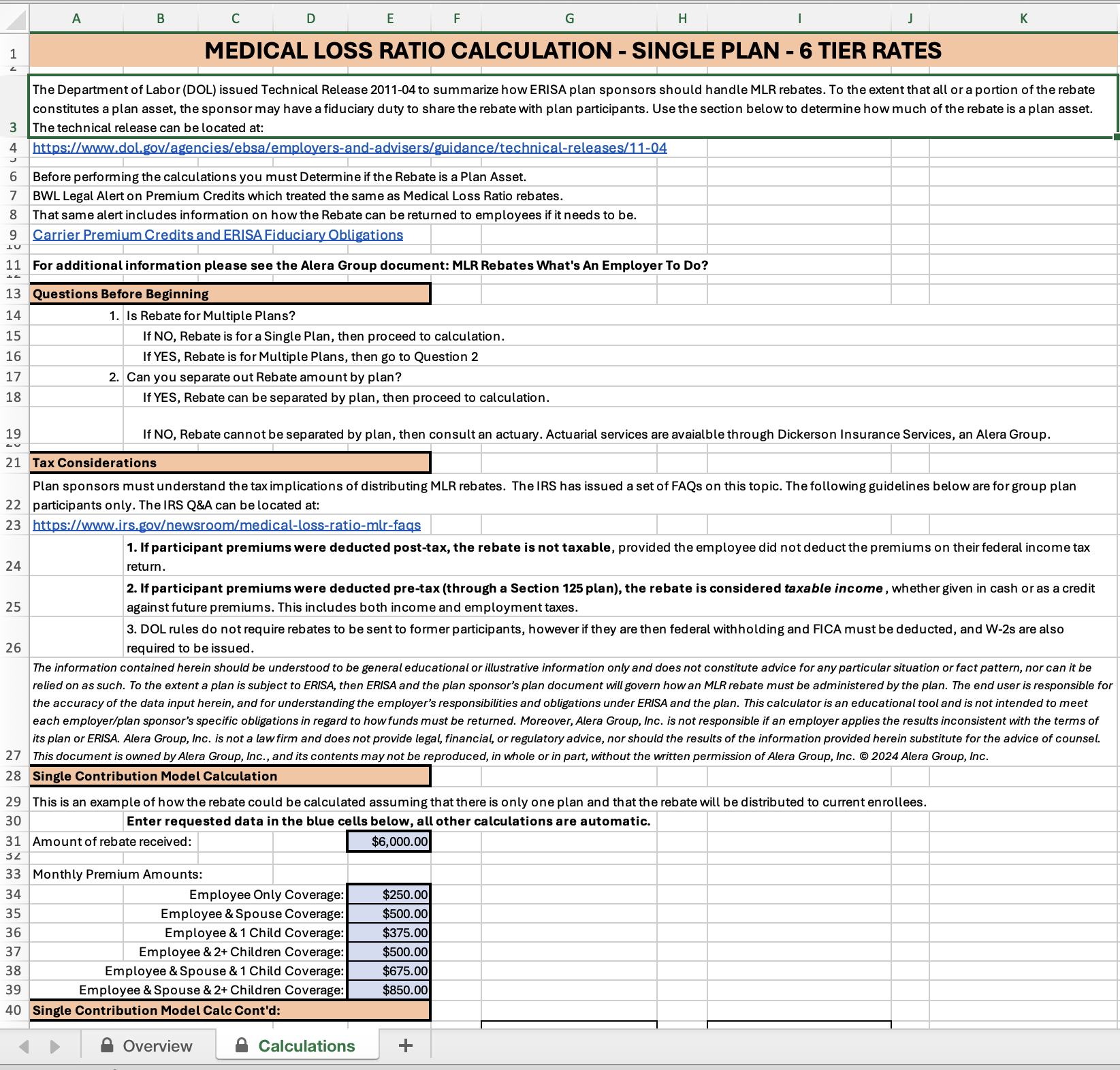

Medical Loss Ratio Calculation-Single Plan-4 Tier Rates ERISA Plan sponsors may have a fiduciary duty to share MLR rebates with plan participants. Use this calculator to determine how much of the rebate is a plan asset. Updated September 30, 2024 |  Medical Loss Ratio Calculation-Single Plan-6 Tier Rates Sponsors may have a fiduciary duty to share MLR rebates with plan participants. Use this calculator to determine how much of the rebate is a plan asset. Updated September 30, 2024 |

Medical Loss Ratio Calculation-Single Plan-Age Related Contribution Model Use this spreadsheet to calculate how ERISA plan sponsors should handle MRL rebates. | |||